Employers can personalize benefits.

We are the industry leader in providing employers the ability to offer a visionary customized defined contribution benefit plan that is competitive and flexible. TASC’s Universal Benefit Account is built from an endless aisle of benefit choices, including FSA, HSA and HRA programs. Employers can select benefits – choosing from reimbursement for gas, tuition, child care expenses and many more – that allow employees to craft packages that meet their lifestyle, which helps attract and retain talent.

Custom Contribution Plan

Simply a new spin on an old concept to meet the needs of today's workforce. A Custom Contribution Plan is a Section 125 Cafeteria Plan where employers contribute a defined benefit amount to their employees to use as they wish. The dollars can be distributed into taxable and nontaxable accounts that meet their individual and family needs.

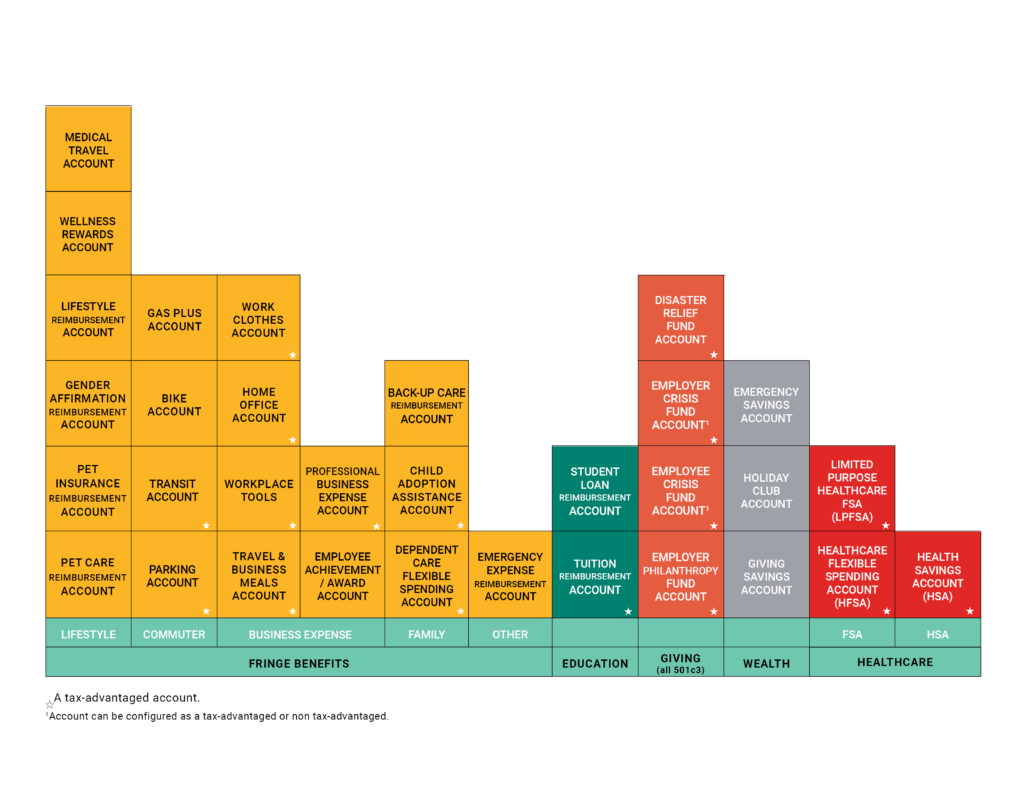

A Single Solution with an Endless Aisle of Accounts

Employers want to save money and time with the flexibility to change in moments notice. With a variety of benefit choices, businesses create the plan that matches their workforce. Our benefits are managed with one account, one website, one mobile app and one card.

Benefit Plan Advisors

Our Plan Advisors help you navigate benefit account options to assist in developing a comprehensive package. We help you find solutions and provide answers to questions. Create a plan that supports your business.

Why Choose a Custom Contribution Plan

Are you struggling to attract and retain employees? Or maybe you’re looking for ideas on how to save on costs, time, or appeal to all generations within the workforce. Businesses are turning to restructure their benefits for a competitive advantage in the market and appeal to a variety of lifestyles in a multi-generational workplace. Versatile, custom-built benefits options are the wave of the future, and your company can be at the cutting edge with a value proposition that employees appreciate.

Did you know?

According to the Society of Human Resource Management, the cost of employee turnover is between 100% and 200% of base salary. This includes the loss of productivity, time and resources to recruit and hire, onboarding and training of the new employee.

Attract

Standout in the market and attract new employees with an industry-changing comprehensive benefits package that competitors can’t match.

Retain

Build loyalty, productivity and valuable experience with benefits that meet employees where they are in life and in their career.

Lifestyle Matters

Be a trailblazer who eliminates the one-size-fits-all plans that are tying the hands of each business and employees. Let your staff pick and choose benefits that are meaningful to them.

Flexibility

Our benefits solutions support your business by providing versatility in a rapidly changing environment. Stay on top of the churn by offering a plan that is ahead of its time.

Configuration

Find the perfect mix of accounts, features and functions that your employees demand and deserve with our highly configurable system, year after year.

Tangible Benefits

Giving employees ownership of benefits that impact their lives adds to their total compensation package. They feel valued and cared about, which builds morale.

Universal Benefit Account

Smart. Easy. Connected.

A revolutionary, integrated, and configurable financial service cloud-native SaaS platform offering a variety of benefit accounts. A platform designed around how people actually think, rather than overcomplicated rules and regulations.

Universal Benefit Account provides smart user experiences, an easy and intuitive way to integrate into peoples’ lives with the technology they already use, and a connected solution with one website, one card and one mobile app.

Think beyond traditional benefits

The benefit accounts are virtually endless!

Our benefit plan account offerings include the categories of healthcare, fringe, education, wellness, giving, and more. Employers can customize a menu of benefit accounts that works for the employees it serves. The employer sets a dollar amount to spend for all eligible employees, and the employee chooses the accounts where they want to spend the money. The configurability and benefit accounts are virtually endless!

Staying ahead of the market & competition

TASC has over 45 years of experience saving businesses tax dollars in employee benefits. We remain steadfast into the future focused on our customers, growing our business, and innovating to deliver human-centric services. We set ourselves apart from the competition by offering the following:

- Highly configurable plan designs

- Variety of Funding arrangements

- Modern, industry-leading technology

- File processing & data exchange

- Single-sign-on (SSO)

- Competitive fees

- Potential to reduce payroll tax liability

- Uniform coverage

- Knowledgeable Customer Service

- Compliant Plan Documents

- Exclusive audit guarantee

TASC is bringing back the real intent of benefits: to help employees improve their health, wealth and well-being for themselves and the people they care about most. TASC helps you offer an unrivaled benefit plan to your employees without adding additional workload. Consult with a Plan Advisor today.

Plan Advisor Consultation

Client Onboarding Experience

Once your TASC application has been submitted and processed, there are a few steps you should expect next in the client onboarding experience. Here’s what you can expect…

1.Onboarding

An Onboarding Specialist will connect with you to go over your plan and configuration requirements. They will walk you through access and administration in our system and answer any questions you may have about your benefit arrangement. Scheduling your Onboarding call is important and very easy to do via the Calendly app. Watch for an email to schedule a time.

2. Upload Census

After your Onboarding Call, you'll upload your employee census file with all necessary demographic info into the Universal Benefit Account platform. We'll use the census data to create participant accounts and assign TASC IDs. Be sure to share the Employer & Employee TASC ID with each employee. They will need this ID to enroll and contact Customer Care.

3. Enrollment

There are a variety of ways of enrolling employees. You choose the appropriate method(s) and communicate to employees which method is preferred. The employee will make their desired account selection and elect an amount.

Enrollments will need to be submitted no later than 30 days prior to the first date of their plan year.

View Enrollment Methods

4. Contributions

And last but not least, typically, employers choose to send their employee contributions on the same cycle as their payroll. Setting up ACH is the fastest and best way to guarantee employee accounts are funded on time so participants can access their funds timely.

Enrollment Methods

We have a few methods to meet the needs of each employer’s preferred enrollment process. We recommend consulting with your HRIS provider to determine if their enrollment process can accommodate Custom Contribution Plans and the specified account offerings chosen. If not, we also have a mobile responsive self-enrollment or paper form to collect employee enrollments. Choose one or more method, but its important to have all enrollment information gathered and submitted 30 days prior to the plan year start date. The processing of enrollment information is key to several downstream processes that affect employee accessibility to benefit elections.

HRIS System

If you use a Human Resource Information System (HRIS), they may accommodate Custom Contribution accounts in their standard enrollment process.

Paper

Some employers prefer paper enrollment -- no problem! We'll provide a standard enrollment form to have employees submit their elections for the plan year.

Web enrollment

Another enrollment method may be to distribute an electronic, mobile-friendly enrollment form. We'll work with you to design a custom enrollment form. A unique URL may be delivered to your employees for enrollment.

Enrollment Submission

Once you have chosen an enrollment method, the submission process into TASC is just as easy. We recommend all enrollment information be gathered 30 days before the first date of your plan start date. This provides enough time to process the information accurately and timely, allowing your employees to access their benefits timely.

File Upload

A CSV file upload in Universal Benefit Account makes this process pain free. There's a file template you download and use to collect your employee's enrollment information. You simply upload the file in our Universal Benefit Account platform once complete.

Vendor File

Many of our clients use a third-party to submit their enrollment information. If the third-party is new to TASC, simply share the census and enrollment CSV file specifications with your vendor and they'll submit directly to TASC for processing.

Single Employee

You may manually add a single employee in your Universal Benefit Account User Experience via the Employee tools.